On 28 September 2015, the annual conference of IRPWind took place in Amsterdam and EWEA’s Chief Policy Officer Kristian Ruby delivered a keynote speech on research and innovation (R&I). The main points from the conference are summarized below.

Europe is still at the forefront when it comes to know-how on wind energy. This particularly applies to the offshore market where Europe accounts for 92% of global installed offshore capacity. However, other countries have stepped up their efforts. Close collaboration between industry and research institutions as well as the EU’s R&I budget, Horizon 2020, are therefore key in asserting Europe’s current leading position.

The Horizon2020 (H2020) programme helps to meet European R&I needs and equips the EU for the global race. Spanning seven years (2014 – 2020) and working with a budget of €77bn, H2020 is the biggest EU research funding programme ever. Compared to previous R&I funding schemes of the EU, it now provides more money to non-nuclear energy research (€5.6 billion against the €3.8 billion allocated from the 7th Framework Programme and the Competitiveness and Innovation Framework Programme together).

In October 2015, the second H2020 adopted Work Programme (WP) for 2016-2017 was published. It offers nearly €16bn, out of which €723 million go to competitive low-carbon energy. Other sub-programmes and priorities also fund R&I for renewable energy, for example, a dedicated instrument supporting small and medium size enterprises (SME) with € 740 million and the European Research Council (ERC) with €1.7bn.

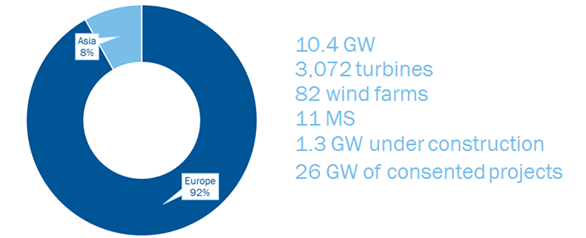

Next to onshore wind deployment, offshore wind is one of the key priorities for the 2016-2017 WP calls. Studies show that investing in offshore wind could contribute to decarbonise the energy sector at a cost of €4bn lower than a nuclear scenario (Ernst & Young March 2015). With 10 GW installed (including 2 GW this year alone), the EU dominates the offshore wind market today.

Fig.: Installed capacity of offshore wind, 2014

Europe-based manufactures accounted for 39% of all wind turbines produced in the world in 2014. In comparison, China-based manufactures accounted for 33%, and US-based manufactures for 10%.

Although Europe remains a major green investor with $4.3 bn in 2014, China is poised to lead in R&I by 2019, also due to the surge in government investments in renewable energy R&I (BNEF and OECD).

For more information, please contact Edit Lulu Nielsen

.